Shares of TEM surged today after the company released its quarterly earnings report, beating analysts' expectations across the board. The tech giant reported impressive revenue and profitability for the quarter, driving investor optimism.

The company's leadership| stated that these results reflect the company's dedication to innovation and its ability to deliver in a challenging market.

Analysts are now predicting continued success for TEM in the coming year.

Should You Buy TEM Stock? Analyst Opinions

Analysts are actively weighing in on the future of TEM holdings. Recent data have been volatile, leaving investors wondering about its potential. Some analysts see promise in TEM's long-term prospects, pointing to indicators such as expanding customer base. However, others express concern about risks like increasing competition.

- Industry experts are providing diverse perspectives on TEM stock. Some recommend a buy, while others urge caution.

- Ultimately, the decision of whether to buy TEM stock depends on an investor's individual risk tolerance. It is crucial to conduct thorough research all available information before making any trading moves.

Might TEM Stock Undervalued? Exploring Investment Potential

TEM Industries has recently seen some shares drop to a attractive price. This prompts the question: is TEM stock undervalued? Analysts are split on the issue, with various arguing that the company's current financial results don't justify the current share price. However, others argue that TEM has solid fundamentals and is poised for anticipated growth.

To truly understand TEM's investment potential, it's essential to perform a thorough analysis of the company's business. This should consider factors such as its sector position, opponent landscape, financial health, and management.

TEM Stock Performance: Analyzing Recent Trends and Catalysts

The share performance of TEM has been a topic of intense interest recently, with investors closely monitoring its direction. Recent trends in the market have affected TEM's price, website resulting in both gains. To understand these movements better, it is crucial to examine the key catalysts driving its current performance.

Multiple factors are contributing TEM's stock price, including company-related conditions. Experts are currently assessing the probability of these catalysts continuing in the foreseeable future, which will finally shape TEM's performance.

TEM Stock Dividend History and Future Prospects

Assessing the past performance of TEM stock dividends provides insight into a pattern of unpredictable payouts. The company has a legacy of issuing dividends to investors, indicating a commitment to creating wealth. Looking ahead, the future prospects for TEM stock dividends are uncertain. Factors such as market conditions will influence the company's dividend policy.

- TEM's dividend history suggests a volatile approach to payouts.

- Analysts predict that TEM may maintain its dividends in the coming years.

- The company's solid footing provides a basis for continued dividend payments.

It is important to evaluate various factors when making investment strategies. Conducting thorough analysis and consulting with a investment professional can help investors make informed decisions regarding TEM stock dividends.

Hurdles and Opportunities for TEM Stock in 2024

As we proceed into 2024, the outlook for TEM stock presents both considerable challenges and promising opportunities. Analysts are closely monitoring a number of influences that could impact the performance of TEM stock throughout the year. Global conditions remain uncertain, and price pressures continue to erode corporate profits. Additionally, industry dynamics within the TEM sector is becoming more competitive, putting pressure on companies to adapt and persist ahead of the curve. However, despite these challenges, TEM stock also offers a number of attractive opportunities. Innovations in the field are creating new markets for TEM products and solutions. Furthermore, growing industry demand for sustainable and responsible solutions presents a unique advantage for TEM companies to grow their market share.

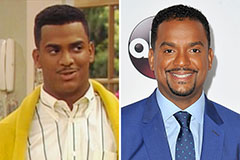

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!